COI Trippie Redd - What You Need To Know About Proof Of Coverage

Have you ever stopped to think about all the little pieces of paper that keep the wheels of business turning smoothly? Well, that, is that, there are quite a few, and some are more important than you might first imagine.

One of those truly important papers is something often called a Certificate of Insurance, or COI for short. It's a rather straightforward document, but it holds a lot of weight when you're doing business, whether you're a small operation or, perhaps, a larger entity. This paper basically tells others that you've got your protection in place, which can make a big difference in how people view your reliability and readiness for any sort of project or venture.

So, in some respects, if you've ever wondered about how businesses show they're covered, or perhaps even if someone like a creative artist or performer needs to prove they have insurance, then understanding a COI is pretty key. It’s all about making sure everyone feels a bit safer and more secure when working together, just knowing that certain risks are accounted for. This information could be helpful for anyone, really, including those who might be involved in bigger productions or public appearances where proof of coverage is often asked for.

- Jojo Siwa Teeth

- Kevin Hart Cheated On His Wife

- Jade Cargill Daughter

- Brittany Tiffany Coffland

- Charlie Freeman Age

Table of Contents

- What's a COI, and Why Might "coi trippie redd" Be a Thing?

- Getting Your COI for Your Projects, "coi trippie redd" Style

- Who Needs Proof of Coverage, "coi trippie redd" or Anyone Else?

- How Does a COI Help Avoid Trouble, "coi trippie redd" Considerations?

- Looking at the COI Document - What It Tells You About "coi trippie redd" Protection

- Accessing Your COI - Simple Ways for "coi trippie redd" and Others

What's a COI, and Why Might "coi trippie redd" Be a Thing?

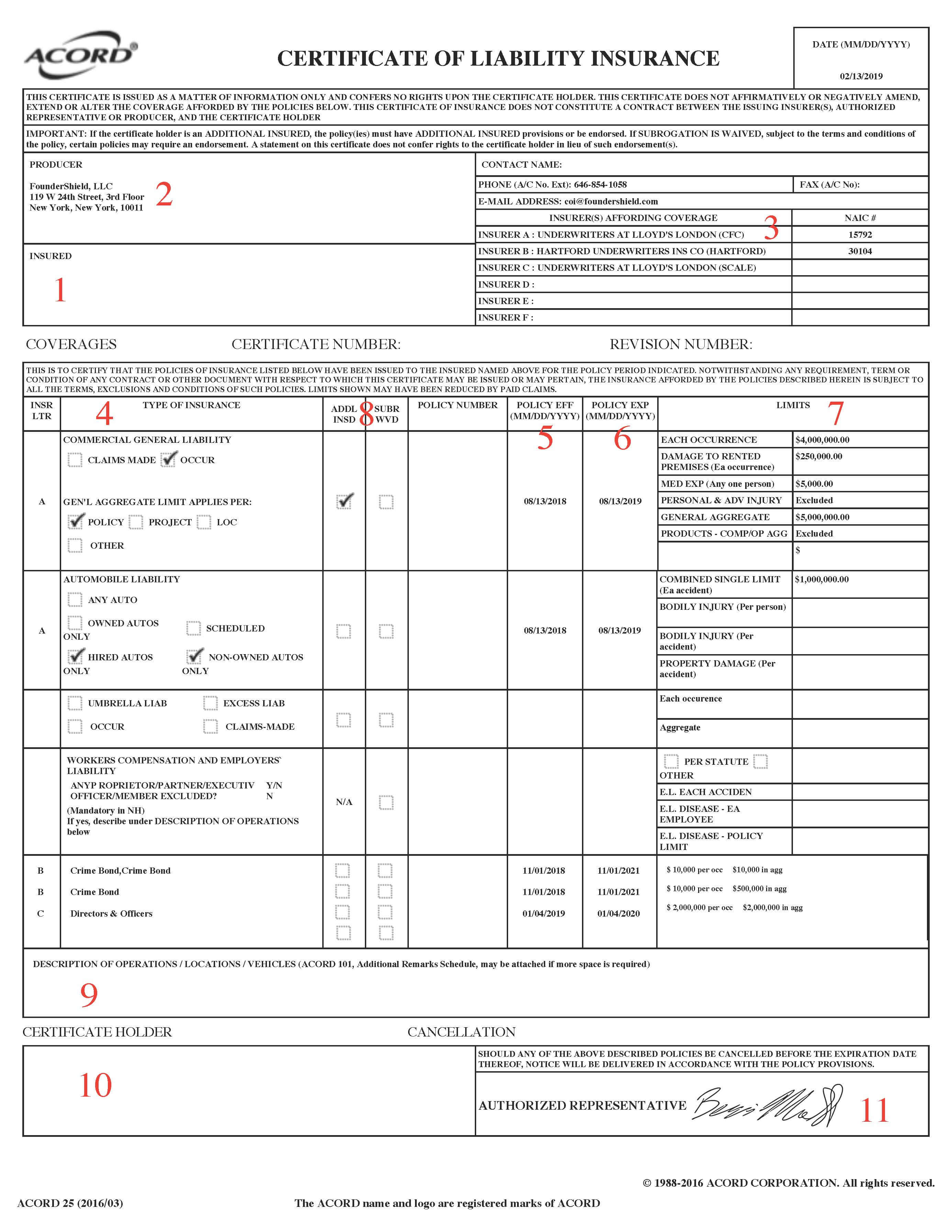

A Certificate of Insurance, often shortened to COI, is, in a way, a very important paper. It's not something you can haggle over or change, it simply comes from an insurance company or perhaps a helper who deals with insurance, and its main job is just to say that an insurance policy truly exists. It's a straightforward statement that your protection plan is active and ready.

This document is, you know, basically a formal confirmation. It's like a note from the folks who provide your coverage, just making it clear that you actually have an insurance plan in place. This kind of note is often needed when you're working with other businesses or individuals who want to be sure that you are protected against certain unexpected happenings. It gives them a sense of security, which is pretty valuable in any sort of arrangement.

Think of it like this: if you're putting on an event or doing a big project, the people you're working with might want some assurance that if something goes wrong, there's a plan to cover it. That's where this paper comes in, basically. It's a simple, yet powerful, piece of proof that you've thought ahead and taken steps to protect yourself and others involved. It's just a little something that can make a big difference in building trust and making sure everyone feels comfortable moving forward.

- Only Fans Star Dead

- Daveed Diggs And Emmy Raver

- Are Andrea And Rob Together

- Are The Amas Pre Recorded

- Jonathan Stanko Barstool

Getting Your COI for Your Projects, "coi trippie redd" Style

So, you might be wondering how you actually get your hands on one of these important COI papers. Well, it's actually pretty simple, you know. You can usually get this document directly from the people who provide your insurance coverage. They're the ones who issued the policy in the first place, so they're the right folks to give you the proof of it.

It's not like you have to go on a big hunt for it, basically. Your insurance provider, the company or person you got your policy from, is the one who can give you this paper. They have all the details about your plan, so creating this certificate is a fairly standard part of what they do. It's a rather common request, especially if you're involved in different kinds of work or projects where others need to see your proof of coverage.

For instance, some services, like Simply Business, make it really easy to manage these documents. They let you look at, keep track of, and even send out your COI whenever you need to, any time of day or night. You can do this using your online account with them or through a handy digital helper they might have. It's pretty convenient, allowing you to access your proof of protection just when you need it, which is useful for all sorts of situations where you might need to show you're covered, perhaps for a new venture or even a creative collaboration.

Who Needs Proof of Coverage, "coi trippie redd" or Anyone Else?

At its heart, a Certificate of Insurance is just a paper from an insurance provider that shows you've got business protection. It’s also known by a couple of other names, too it's almost always called a certificate of responsibility coverage or simply proof that you're covered. These different names all point to the same thing: a document that says your business has an active insurance plan.

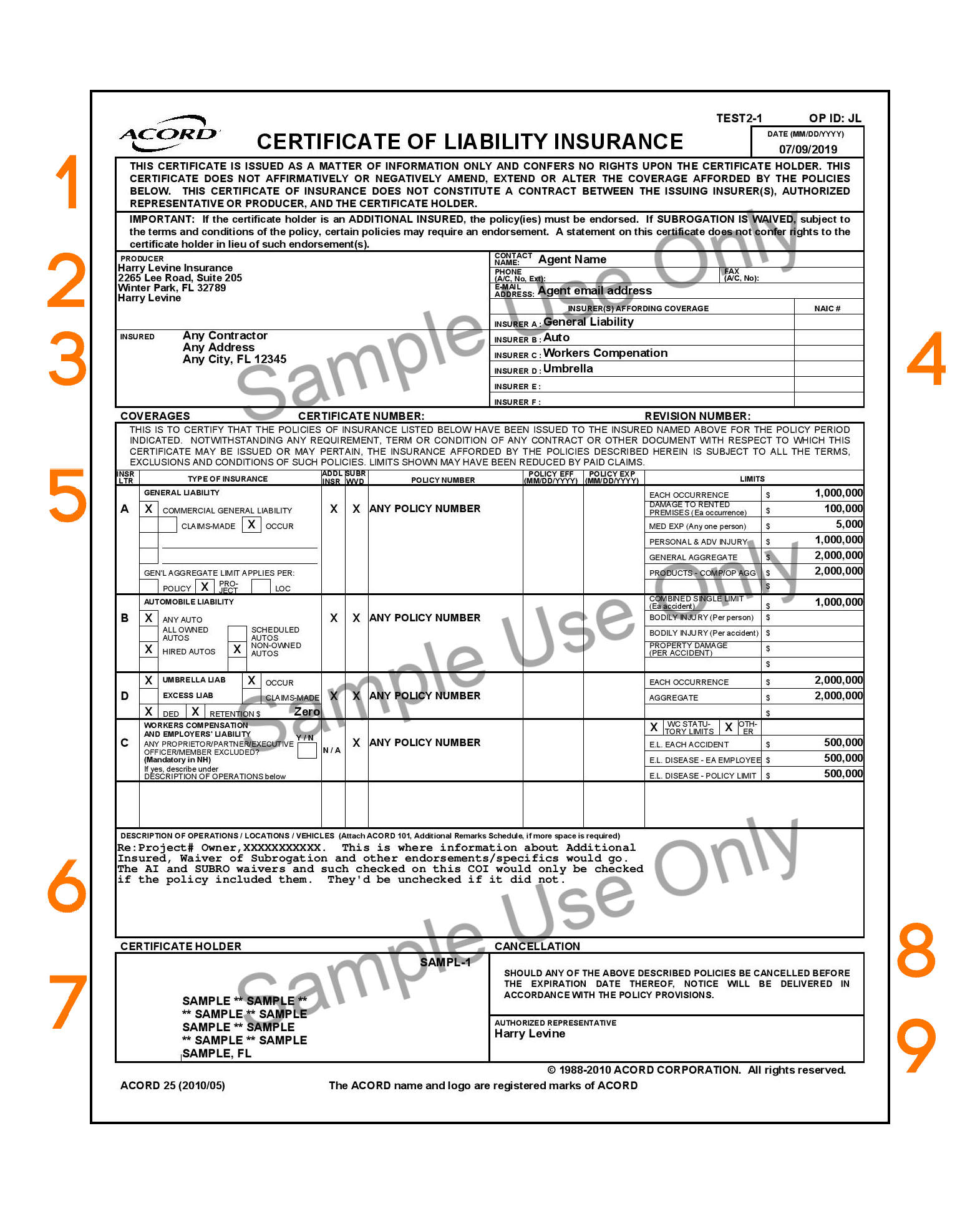

This little piece of paper, you know, gives you proof of your protection. It includes some really important details about your plan, like what exactly it covers, how much it covers up to, and the specific dates when your coverage is active. But, and this is important, it’s not the full, big contract itself. It’s more like a quick summary, giving just the key facts without all the tiny print.

Having proof of protection is, in a way, really important for smaller businesses and people who work on projects. It helps them keep away potential problems or being held responsible for things that go wrong. You might want to learn more about what a COI is, how you get one, who really needs it, and why it matters so much. It’s a pretty fundamental aspect of doing business safely and responsibly, ensuring that you're prepared for unexpected events.

How Does a COI Help Avoid Trouble, "coi trippie redd" Considerations?

So, what exactly is a Certificate of Insurance? Well, it's a paper that an insurance company or a broker, someone who helps you with insurance, gives out. This paper just confirms that an active insurance plan is indeed in place. It's a way to formally say, "Yes, this person or business is covered."

A COI is a truly important paper that shows you have protection. It’s often used in business dealings and agreements to make sure that a person or a company is indeed covered by insurance. This helps everyone feel more secure, knowing that there's a safety net if something unexpected happens. It's a rather common practice to ask for one, especially before starting any new partnership or project, just to make sure all parties are on the same page regarding protection.

This paper, from an insurance company or a broker, confirms that you have insurance coverage under specific conditions. It gives a quick look at your insurance plan without showing the whole big agreement. The document points out the person or group that's protected, usually naming the business or the individual who has the coverage. It’s a very handy tool for making sure everyone understands the basic terms of your protection without having to read through every single line of your full policy.

Looking at the COI Document - What It Tells You About "coi trippie redd" Protection

When you get your hands on a Certificate of Insurance, or COI, it’s not just a blank piece of paper, you know. It’s actually packed with some pretty important information, even though it’s not the full insurance contract itself. This document is like a quick summary, giving you the key details at a glance, which is pretty useful when someone asks for proof of your protection.

The COI will typically tell you things like the type of coverage you have. Is it general responsibility coverage? Or maybe something more specific? It also lists the limits of that coverage, basically how much the insurance plan would pay out if something happened. This is a very important detail, as it tells you the extent of your protection, which is good for everyone involved to know.

And then there are the effective dates. This is, in a way, super important because it tells you exactly when your coverage starts and when it ends. You wouldn't want to show proof of a plan that's already run out, right? So, this document clearly lays out the period during which your insurance is active. It’s all about making sure that the protection is valid for the time period when it’s needed, which is a key part of any business arrangement.

Beyond the Basics - What Else Does a COI Show for "coi trippie redd" Situations?

Beyond just the type of coverage, its limits, and the dates, a COI also clearly identifies who the protected party is. This means it typically lists the business or the individual who is covered by the insurance plan. This is pretty fundamental, as it confirms exactly whose protection is being verified by the document. It’s a very clear way to make sure there’s no confusion about who the policy is actually for.

Sometimes, too it's almost, the document might even list additional protected parties if that’s part of your specific arrangement. For instance, if you’re working on a big project, the people you’re working for might want to be named on your certificate as an additional protected party. This is a common request and helps to make sure everyone involved feels secure. It’s just another way this paper helps to cover all the bases.

So, while it’s not the full, detailed contract, the COI gives you all the crucial bits of information you need to show someone that you are indeed covered. It’s a very helpful tool for showing responsibility and readiness, whether you’re a contractor, a small business owner, or perhaps even someone in the creative field who needs to show proof of their protection for various projects or appearances.

Accessing Your COI - Simple Ways for "coi trippie redd" and Others

Getting your Certificate of Insurance is, as we talked about, usually pretty straightforward, coming directly from your insurance provider. But how do you actually get your hands on it and manage it once you have it? Well, many modern insurance services have made this process incredibly simple and accessible, which is a real convenience for anyone needing this document.

For example, some companies offer online accounts where you can access your COI any time you need it. This means you don't have to wait for business hours or call someone up every time you need to send a copy. You can just log in, find your document, and manage it yourself. It’s pretty empowering to have that kind of control over your own important papers, just when you need them.

They often have digital assistants or easy-to-use online portals that let you not only look at your COI but also manage and share it with others. This means you can quickly send a copy to a client, a venue, or anyone else who needs proof of your protection, all from your computer or even your phone. This kind of access, you know, makes life a lot easier for busy individuals and businesses alike, ensuring that proof of coverage is always just a few clicks away.

Short Forms of Proof - What About "coi trippie redd" Policy Numbers?

Occasionally, it’s not just businesses or contractors who need to

Article Recommendations

- Maggianos Shrimp Fra Diavolo

- New Signed Sealed Delivered

- Meryl Streep And Amanda Seyfried

- Liev Schreiber News

- Charlie Freeman Age

Detail Author:

- Name : Viva Schuster

- Username : enos44

- Email : sandy22@lesch.net

- Birthdate : 2002-07-27

- Address : 31352 Mann Corners Sallietown, WY 43856-1451

- Phone : (239) 644-1397

- Company : Hodkiewicz, Mann and Rutherford

- Job : Healthcare Practitioner

- Bio : Cupiditate laudantium eligendi earum qui libero nemo et. Sed tempore beatae facere maxime eos corporis. Error tenetur corporis sed velit expedita aut.

Socials

instagram:

- url : https://instagram.com/cheyanne_official

- username : cheyanne_official

- bio : Modi error cupiditate enim aut. Provident ad quo sed est. Suscipit dignissimos odit nobis ut.

- followers : 1377

- following : 2469

linkedin:

- url : https://linkedin.com/in/cheyanne2146

- username : cheyanne2146

- bio : Error nam sed voluptas aperiam.

- followers : 1412

- following : 2333

twitter:

- url : https://twitter.com/cheyanne_frami

- username : cheyanne_frami

- bio : Occaecati dolores mollitia rerum. A vitae mollitia voluptatem. Explicabo ullam qui expedita sunt labore. Voluptatem omnis expedita enim in similique.

- followers : 6466

- following : 1835

facebook:

- url : https://facebook.com/cheyanneframi

- username : cheyanneframi

- bio : Minima blanditiis temporibus illo error qui sequi quis.

- followers : 6619

- following : 2846

tiktok:

- url : https://tiktok.com/@cheyanne306

- username : cheyanne306

- bio : Placeat officiis inventore dolores voluptas sunt.

- followers : 6864

- following : 1476